Revenue Cycle Management, commonly referred to as RCM, is the financial backbone of healthcare organizations. It refers to the complete administrative and clinical process that tracks a patient’s journey from the moment an appointment is scheduled to the final resolution of the account when all payments are collected. The purpose of RCM is to ensure that providers are reimbursed accurately and efficiently for the services they deliver, while also complying with the strict rules set by payers and regulatory bodies.

RCM is more than medical billing. While billing is one part of the cycle, Revenue Cycle Management is an integrated process that involves patient registration, eligibility verification, clinical documentation, charge capture, coding, claim submission, denial resolution, and patient collections. A well-functioning RCM process not only secures timely cash flow but also reduces administrative burdens, improves patient satisfaction, and keeps practices compliant with healthcare regulations issued by organizations such as the Centers for Medicare & Medicaid Services (CMS).

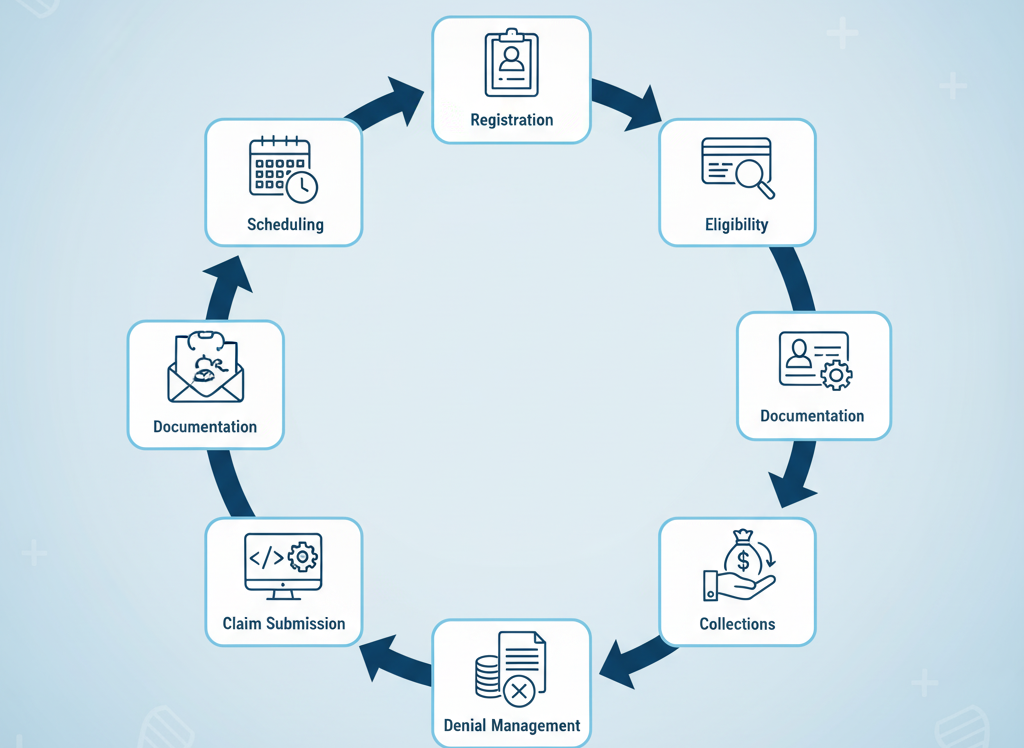

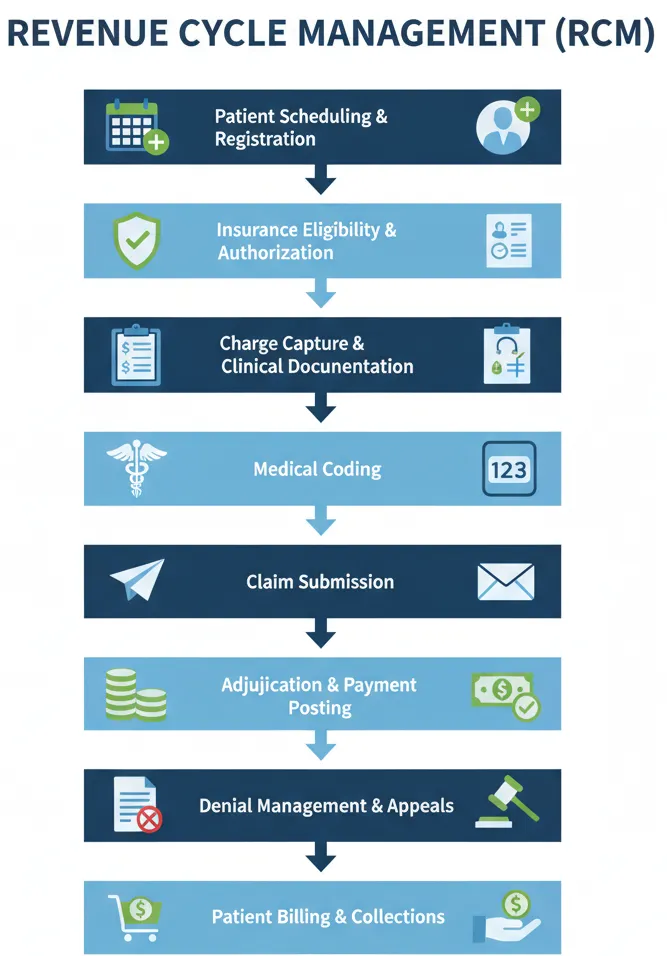

Step-by-Step Process of Revenue Cycle Management

The RCM process can be divided into sequential steps, each of which plays a critical role in the overall cycle. Any error or delay at one stage creates ripple effects that impact revenue collection, compliance, and patient experience.

Patient Scheduling and Registration

The revenue cycle begins before a patient even enters the facility. When a patient schedules an appointment, the provider collects demographic information, insurance details, and reason for the visit. At registration, this information is verified and entered into the practice management or electronic health record system. Accuracy at this stage is vital because errors in a patient’s name, insurance ID, or date of birth can lead to immediate claim rejections.

Insurance Eligibility and Authorization

Once registration is complete, the next step is to confirm the patient’s insurance coverage. Staff check eligibility in real time and determine whether prior authorization is required for the planned services. For instance, many procedures and advanced imaging tests require pre-approval from payers. Failure to obtain authorization is one of the leading causes of denied claims, making this step essential for a smooth revenue cycle.

Charge Capture and Clinical Documentation

After the patient receives care, providers must document all services delivered. Charge capture refers to recording those services accurately in the system so that they can be billed. Clinical documentation is the foundation here—it must be detailed, accurate, and compliant with payer guidelines. Documentation errors not only slow down the cycle but also create compliance risks during audits by entities such as the American Medical Association (AMA).

Medical Coding

Once services are documented, coding specialists translate them into standardized medical codes such as ICD-10-CM for diagnoses and CPT/HCPCS codes for procedures. Coding ensures that the services provided are represented correctly for reimbursement. Proper coding requires both technical knowledge and regulatory awareness. For example, coding guidelines issued by the AAPC highlight that incorrect use of modifiers can lead to underpayment or even allegations of fraud.

Claim Submission

When coding is complete, claims are generated and submitted to payers. In most cases, claims are sent electronically through clearinghouses that check them for basic errors before forwarding them to insurance companies. Clean claim submission is critical because rejections delay payment and increase administrative costs. Providers aim for a high first-pass acceptance rate to keep revenue flowing steadily.

Adjudication and Payment Posting

After submission, the payer reviews the claim in a process called adjudication. The insurer determines whether the claim is valid, how much they will reimburse, and whether the patient has any remaining financial responsibility. Once payment is issued, staff post the payment in the system, reconciling it with the original claim to ensure there are no underpayments or discrepancies.

Denial Management and Appeals

Not all claims are paid on first submission. Some are denied due to errors, lack of authorization, or payer-specific rules. Denial management involves analyzing the denial reason, correcting the claim, and resubmitting it. In more complex cases, providers must appeal the decision with supporting documentation. An effective denial management strategy ensures that revenue is not permanently lost and helps reduce recurring errors by feeding lessons back into the process.

Patient Billing and Collections

Finally, after the payer portion is settled, the patient is billed for their share, which may include copayments, deductibles, or services not covered by insurance. Transparent communication with patients is essential here. Many practices now provide cost estimates before treatment and use online payment portals to make collections easier. By improving the patient financial experience, providers increase the likelihood of receiving payments on time while maintaining patient satisfaction.

Compliance in Revenue Cycle Management

Compliance is interwoven into every stage of the RCM process. Healthcare organizations must adhere to complex regulations from CMS, state agencies, and commercial payers, as well as federal laws such as HIPAA that govern patient data privacy.

At the front end, compliance involves verifying insurance eligibility and obtaining necessary authorizations. During documentation and coding, providers must ensure that records support billed services to avoid upcoding or undercoding. At the back end, claims must be submitted in accordance with payer rules, and staff must respond promptly to audits or payer inquiries.

Recent regulations such as the No Surprises Act have also added transparency requirements to patient billing, compelling providers to deliver clear estimates and protect patients from unexpected balance bills. Failure to comply with these rules can result in financial penalties, lost contracts, or even accusations of fraud.

By integrating compliance into the RCM process—through staff training, internal audits, and the use of compliant technology systems—providers safeguard both their revenue and their reputation.

Importance of Revenue Cycle Management

Revenue Cycle Management is not just a financial function—it is the lifeline of any healthcare organization. Without an efficient RCM system, providers face delayed reimbursements, cash flow instability, and administrative bottlenecks that can directly affect patient care. A streamlined revenue cycle ensures that healthcare professionals are paid accurately and on time, allowing them to reinvest resources into clinical services, staff development, and technology upgrades.

For doctors and executives, RCM provides financial visibility. It highlights how revenue moves through the system, from scheduling to collections, and pinpoints where leakage or inefficiencies occur. According to the Centers for Medicare & Medicaid Services, even small errors in eligibility verification or coding can result in millions of dollars in lost reimbursements annually. Effective RCM safeguards against such losses, making it an essential strategy for both financial stability and operational excellence.

Phases of Revenue Cycle Management

The revenue cycle can be divided into three main phases: front-end, mid-cycle, and back-end. Each phase has its own responsibilities, yet they are interconnected, meaning mistakes in one phase often carry over into the next.

The front-end phase begins with patient access, where accurate registration and insurance verification are performed. At this stage, providers also estimate patient responsibility and secure authorizations. This sets the tone for the rest of the cycle.

The mid-cycle phase covers charge capture, clinical documentation, and coding. This is where medical services are translated into billable claims. Accurate documentation and proper coding, guided by standards from organizations like the American Medical Association, are critical to ensure full reimbursement and compliance with payer rules.

The back-end phase focuses on claim submission, denial management, payment posting, and patient collections. Clean claims are submitted to payers, denials are addressed and appealed if necessary, and final balances are billed to patients. The cycle closes when payments are collected, accounts are reconciled, and the provider has received full compensation for the care delivered.

Impact of RCM on Patient Experience

While RCM is often viewed as an internal financial process, its effects are directly felt by patients. A poorly managed revenue cycle leads to billing errors, surprise charges, and lack of transparency—all of which damage patient trust. On the other hand, a well-structured RCM process ensures patients understand their financial responsibility upfront, receive accurate statements, and have multiple options to pay their bills conveniently.

Healthcare consumerism is on the rise, with patients expecting the same transparency and digital convenience they receive in other industries. By integrating cost estimation tools, online payment portals, and clear communication practices into RCM, providers not only improve collections but also strengthen the overall patient experience. This alignment between financial clarity and clinical care builds trust and encourages patients to return for future services.

Role of Technology in RCM

Technology has become indispensable to modern Revenue Cycle Management. From electronic health records to AI-driven claim scrubbing tools, digital solutions are transforming the way providers manage their revenue. Real-time eligibility verification reduces registration errors, while automated coding assistance improves accuracy and speeds up the mid-cycle phase.

Artificial intelligence and machine learning are increasingly used to predict claim denials before submission, allowing staff to correct errors proactively. According to the AAPC, automation in charge capture and coding can reduce claim errors by more than 30%. Similarly, integrated dashboards and analytics provide executives with real-time visibility into key metrics such as days in accounts receivable and denial rates, enabling data-driven decisions.

Technology also enhances the patient financial experience. Online portals give patients the ability to view their balances, receive electronic statements, and pay through secure platforms. This not only shortens collection times but also aligns with patient expectations for convenience and transparency in healthcare.

Conclusion

Revenue Cycle Management is the engine that drives financial health in every healthcare organization. It begins with patient registration and continues through insurance verification, charge capture, coding, claim submission, denial resolution, and patient collections. Each step plays a crucial role in ensuring that providers are reimbursed correctly and promptly.

Doctors and healthcare executives who understand the RCM process in depth can better oversee their organizations, allocate resources effectively, and prevent revenue leakage. Moreover, by embedding compliance into every stage, they can minimize risk, stay aligned with regulations, and protect patient trust.

A well-managed revenue cycle not only strengthens the bottom line but also frees providers to focus on what matters most—delivering high-quality patient care.