Medical Billing is the process by which healthcare providers translate the services they deliver into claims submitted for payment, typically to insurance companies (payors), government payers, or directly to patients. It involves taking clinical documentation (what diagnosis, procedures, treatments were done), converting that into standardized codes, creating claims, submitting them, tracking them, addressing denials, and finally ensuring that reimbursement is received. Without efficient medical billing, providers may suffer delays, underpayments, or compliance risks.

The term "Healthcare Billing" is sometimes used interchangeably with medical billing, though it may imply a broader scope, including patient invoicing, payment collection, and sometimes insurance verification, depending on the organization’s structure.

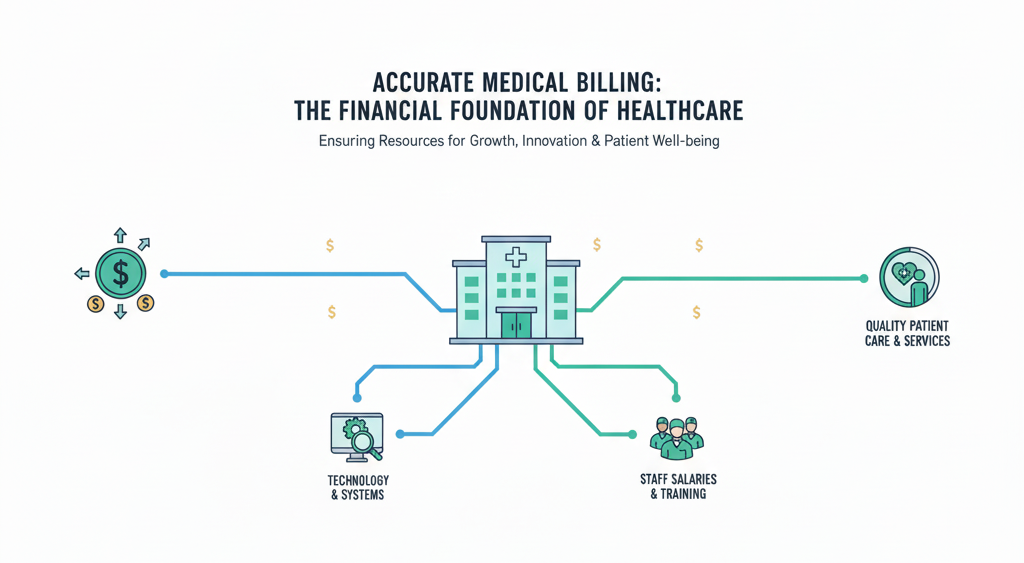

Why Medical Billing Matters

Medical billing is not just paperwork. It’s central to financial health. A practice’s or hospital’s cash flow, sustainability, ability to invest in technology, pay staff, and deliver quality patient care hinges on how well medical billing is done. Mistakes in billing lead to claim denials, delayed payments, revenue leakage, and even compliance penalties. In an era of shrinking margins and increasing regulation, optimized medical billing is a strategic capability, not just an administrative necessity.

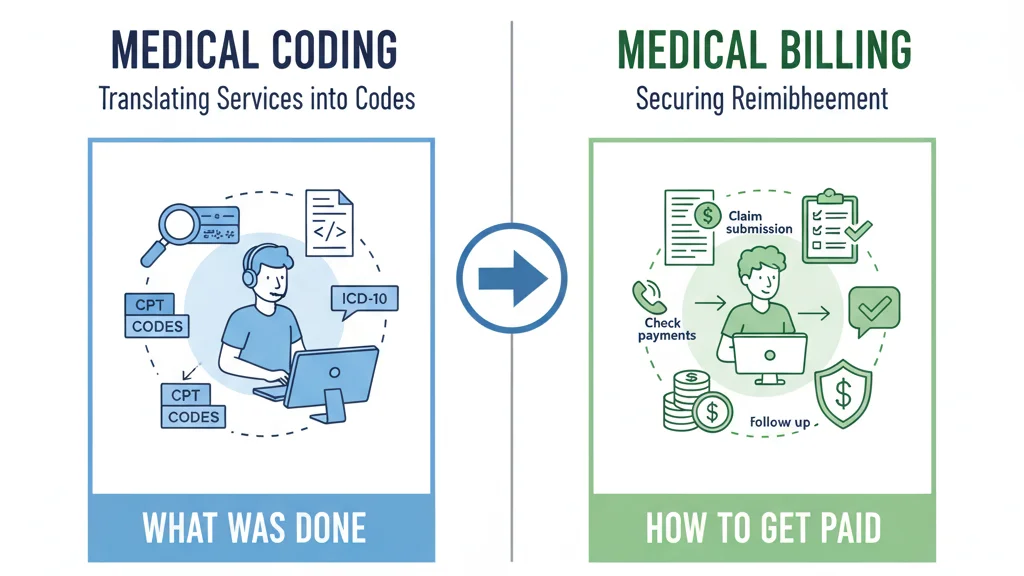

Medical Billing vs. Medical Coding

Understanding the distinction (and the interplay) between medical billing and medical coding is essential for healthcare executives and physicians.

-

Medical Coding is the process of translating diagnosis, services, procedures, and treatments into standardized codes (ICD-10-CM, CPT, HCPCS) based on documentation. It answers “what was done?” and “why was it done?” correctly.

-

Medical Billing then takes those codes, along with patient and insurance information, to assemble and submit claims, follow up, post payments, and work denials. It answers “how to get paid for what was done.”

While sometimes roles are combined, mixing them without clear responsibilities often causes errors and inefficiency.

The Medical Billing Process

The medical billing process is a multi-stage cycle that ensures providers are reimbursed accurately and on time for the services they deliver. Each stage builds upon the previous one, and even small errors can delay payment or cause denials. Below is a step-by-step breakdown.

Patient Registration and Insurance Verification

The process begins when a patient schedules an appointment. Front-office staff collect demographic details, insurance policy numbers, and any secondary coverage. Insurance eligibility is verified in real time or through payer portals to confirm coverage, co-pays, and deductibles. This step reduces the risk of claim rejections and prepares the patient for their financial responsibility.

Charge Capture and Superbill Creation

Once the patient visit is complete, clinicians document the services provided. Certified coders then translate this clinical documentation into standardized codes such as ICD-10, CPT, and HCPCS. A superbill or encounter form is prepared, ensuring all services are captured accurately. This step ensures that nothing billable is missed and that claims meet payer documentation standards.

Claim Preparation and Submission

Once charges are coded and documented, the next step is preparing the medical claim. This is the formal request for payment that a provider submits to an insurance company or government payer. A claim must include accurate patient demographics, provider details, diagnosis codes, procedure codes, and supporting modifiers. Even minor errors—such as a missing digit in a patient’s policy number or an incorrect modifier—can cause immediate rejection or denial.

Clean vs. Dirty Claims

A clean claim is one that is complete, accurate, and compliant with payer requirements, allowing it to be processed without manual intervention. In contrast, a dirty claim contains errors, missing data, or inconsistencies, leading to delays, denials, or resubmissions. Practices strive for a high clean claim rate because it directly impacts cash flow and administrative costs.

Claim Submission Methods

Medical claims can be submitted in two primary ways:

-

Electronic submission: The industry standard, using clearinghouses or direct payer portals. Electronic claims are faster, cheaper, and more accurate due to automated edits and checks.

-

Paper submission: Still used in rare cases, often for small payers, workers’ compensation, or when electronic submission fails. Paper claims are slower and more prone to error but remain necessary in specific situations.

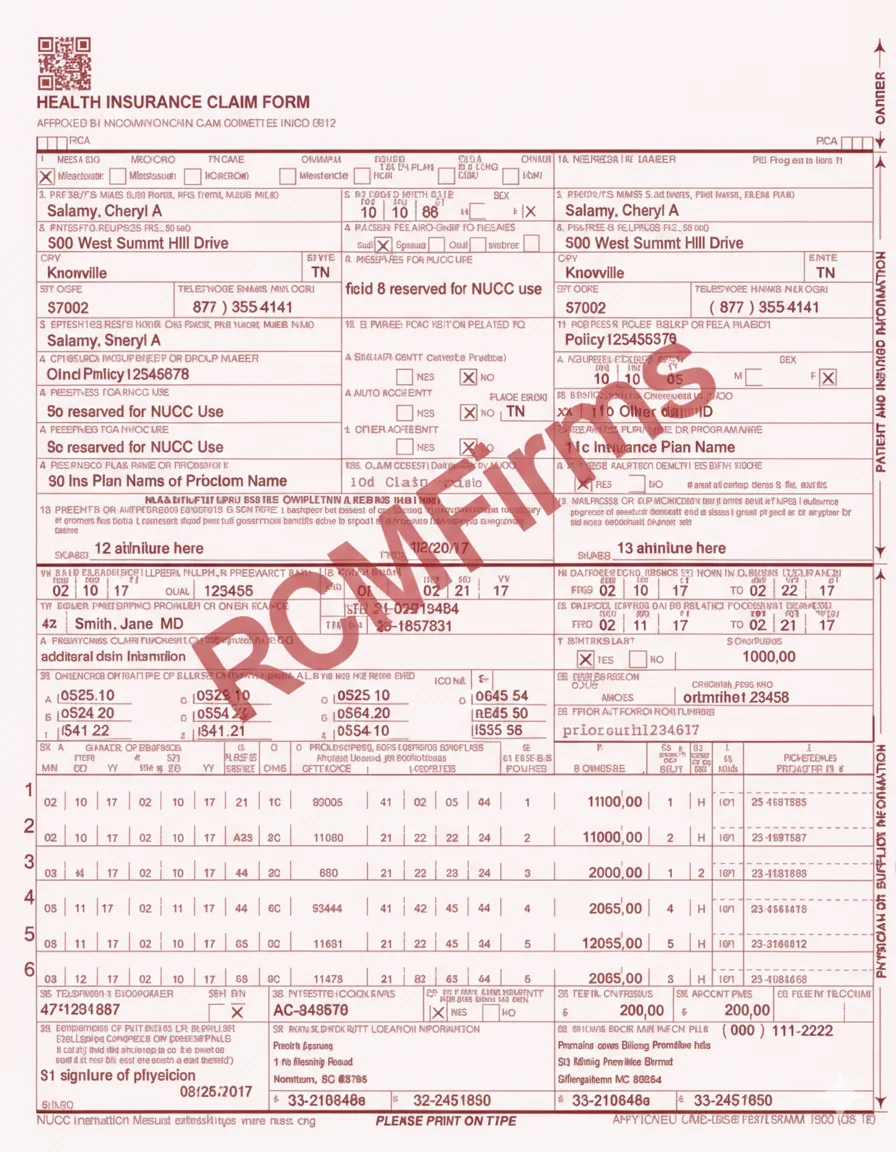

Common Claim Form Types

-

CMS-1500 Form (HCFA-1500)

-

Used primarily by physicians, non-institutional providers, and small practices.

-

Captures patient demographics, insurance details, diagnoses, procedures, and provider identifiers.

-

Standard for Medicare Part B and most private insurers.

-

-

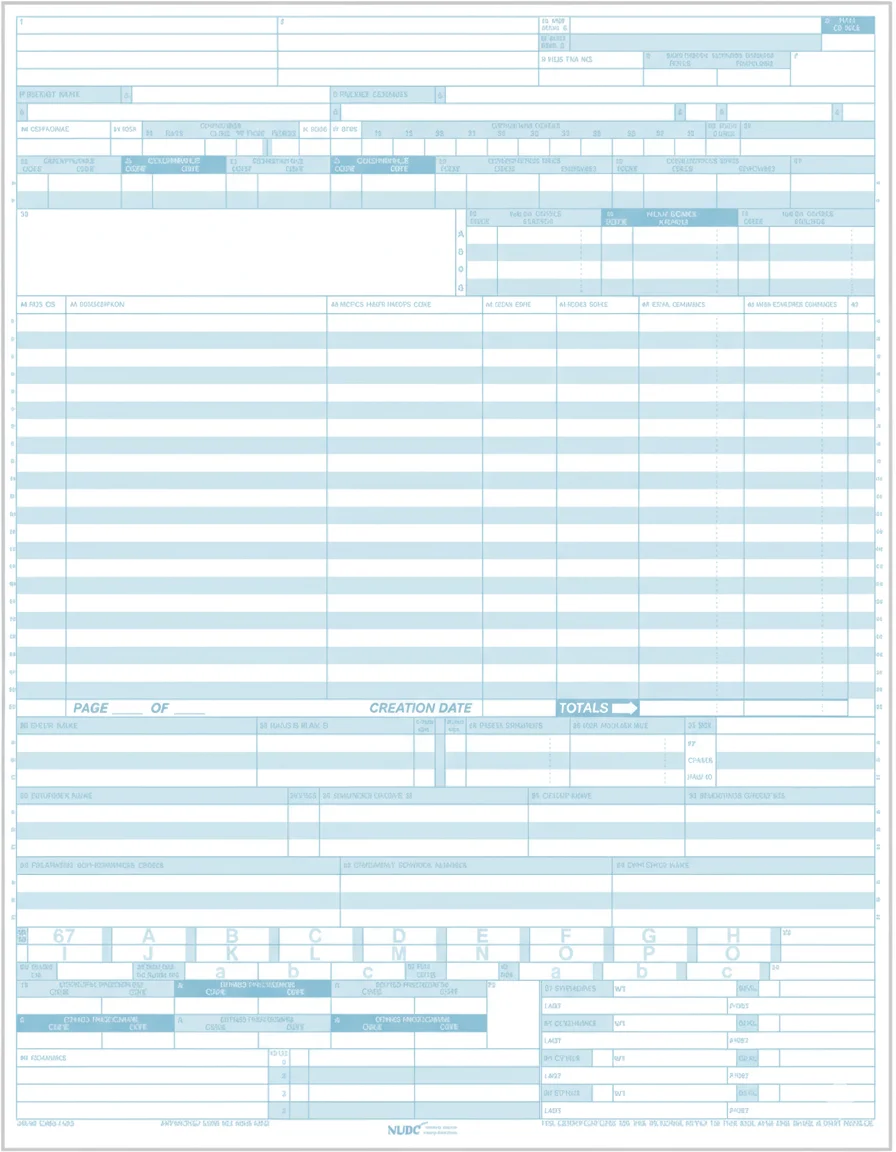

UB-04 Form (CMS-1450)

-

Used by hospitals, inpatient facilities, skilled nursing facilities, and other institutional providers.

-

Includes more complex data, such as revenue codes, admission details, discharge status, and facility identifiers.

-

Standard for Medicare Part A and institutional claims.

-

-

ANSI 837 Electronic Claim Format

-

The electronic equivalent of paper forms, compliant with HIPAA.

-

837P: Professional claims (replaces CMS-1500 electronically).

-

837I: Institutional claims (replaces UB-04 electronically).

-

837D: Dental claims.

-

Required by most payers, including Medicare and Medicaid, for faster processing and audit tracking.

-

Payer-Specific Rules

Every payer has its own unique requirements, such as mandatory use of modifiers, bundling policies, or pre-authorization numbers that must appear on the claim. Failure to follow these rules results in rejections or underpayments. Billers often rely on claim-scrubbing software to check compliance before submission.

Payment Posting and Reconciliation

Once the payer processes the claim, payments or explanations of benefits (EOBs) are received. Billers post payments into the practice management system and reconcile them against expected amounts based on payer contracts. Any underpayments or discrepancies are flagged for follow-up. This step ensures the provider is reimbursed correctly and identifies potential revenue leakage.

Denial and Rejection Management

Claims are often rejected for errors or denied for lack of documentation, missing pre-authorizations, or coding issues. Billers analyze the reason codes, correct the errors, and resubmit the claims. For denials that require appeal, supporting documentation is gathered, and appeals are filed within the payer’s deadline. Effective denial management prevents significant revenue loss and improves the overall collection rate.

Patient Billing and Collections

After payer payments are posted, the remaining patient responsibility—such as co-pays, deductibles, or services not covered—is billed to the patient. Practices send statements, offer payment plans, and may use digital tools for online payments. Clear, transparent communication during this step improves patient satisfaction and trust while ensuring practices collect the balance owed.

Reporting and Performance Monitoring

The final stage involves analyzing billing data to track performance indicators such as days in accounts receivable (A/R), clean claim rate, and denial percentages. Executives and billing managers use these reports to identify bottlenecks, monitor staff performance, and optimize financial outcomes. Ongoing monitoring transforms billing from a reactive function into a proactive revenue strategy.

Compliance, Regulation & Key Risks

For providers and execs, staying compliant is critical. Regulatory oversight, audits, payer rules, and federal laws impose strict requirements.

HIPAA & Data Security

Patient health information must be protected during billing, coding, claim submission, and collections. Breaches can lead to severe fines and reputational damage.

Medical Necessity & Documentation Standards

Payers expect that codes submitted are justified by the medical record. Poor documentation can lead to denials, recoupments, or even legal exposure.

Payer Rules & Contractual Obligations

Different payers (Medicare, Medicaid, commercial insurers) have varying rules—pre-authorizations, coding modifiers, bundling/unbundling rules. Contract terms (fee schedules, allowed amounts) must be understood and adhered to.

Audits, False Claims & Compliance Programs

Providers may be audited by payers or government bodies. False claims (e.g., upcoding, unbundling) can lead to penalties. Effective internal compliance programs are needed.

Regulatory Changes & Transparency Requirements

E.g., hospital price transparency rules, creditor and collections regulations. Keeping up with changing laws (state and federal) is essential.

Common Pain Points & Content Gaps

When analyzing top pages on this topic, the following areas are well covered: definitions, the difference between coding vs billing, standard process steps, importance of accuracy and software/automation.

However, gaps / areas that are less well-addressed, which are important for healthcare executives:

-

Financial impact metrics / benchmarks — What are average denial rates, days in A/R, cost per claim, revenue leakage percentages in different practice sizes or specialties.

-

Technology & automation trends — Use of AI, RPA (Robotic Process Automation), claim scrubbing tools, analytics dashboards, end-to-end RCM software.

-

Outsourcing vs in-house billing — Pros, cons, cost comparisons, risk considerations.

-

Patient experience / transparency — How billing practices affect patient satisfaction, clarity of patient statements, handling of medical debt.

-

Strategy for continuous improvement — Lean or Six Sigma approaches, cross-department collaboration (clinicians, coders, billers), feedback loops.

How Medical Billing Fits into Revenue Cycle Management (RCM)

Medical billing is a crucial component of the broader revenue cycle. While medical billing focuses on claim generation, submission, and follow-up, RCM encompasses everything from pre-service (scheduling, registration), service delivery, billing, collections, up to final cash receipt and analytics. Good billing supports RCM by ensuring efficient, clean claim flows, low denials, and rapid reconciliation so revenue realization is maximized.

Emerging Trends & Best Practices

Healthcare billing is evolving. Some of the latest trends and best practices include:

-

Automation and AI/ML tools for code validation, claim scrubbing, preemptive error detection.

-

Predictive analytics to forecast denials or cash flow risk.

-

Better patient engagement and transparency—clear statements, cost estimates upfront, payment options.

-

Outsourcing / hybrid billing models where specialized billing companies handle parts of the billing cycle.

-

Focus on staff training & continuous education, especially around regulatory changes and payer rule updates.

What to Do as a Doctor or Healthcare Executive

If you lead a practice or hospital, ensure your billing is not siloed. Start by measuring your key billing KPIs: clean claim rate, denial rate, average days in A/R, return on billing cost. Audit documentation for medical necessity. Explore whether your billing tech is up to date—automated tools for claim scrubbing, denials, dashboards. Consider outsourcing or partnering if internal billing costs or error rates are high. Finally, ensure compliance programs are strong to guard against audit risk and penalties.

Conclusion

Medical billing is a backbone function in healthcare finance. It sits at the intersection of clinical documentation, insurance policy, payer contracts, regulation, and patient communication. When done accurately, efficiently, and ethically, it ensures revenue flows, supports organizational stability, and enhances patient trust. For doctors and healthcare executives, investing in skilled billing staff, modern technology, strong documentation, and continuous monitoring will deliver returns—in fewer denials, faster payments, and healthier financial performance.